top of page

Blog

At Gatson Life & Financial Group, our blog is your gateway to understanding the intricacies of insurance. Whether you’re new to the world of insurance or looking to deepen your knowledge, we’ve got you covered. Join me as I share insights, tips, and expert advice to help you navigate this important aspect of financial planning.

Tips for Finding Budget-Friendly Insurance Plans

Finding the right insurance plan can feel overwhelming. You want solid coverage without breaking the bank. I’ve been there, and I know how important it is to balance cost with protection. The good news? There are smart ways to discover budget-friendly insurance plans that fit your needs and your wallet. Let’s walk through practical tips that will help you make confident choices. Whether you’re looking for health, auto, home, or business insurance, these strategies will guide

Rodney Gatson

Jan 224 min read

Business Liability Protection: What You Need to Know About General Liability Insurance

When you run a business or manage your family’s financial security, protecting yourself from unexpected risks is crucial. One of the most important safeguards you can have is business liability protection. It acts as a safety net, shielding you from costly legal claims and financial losses. Today, I want to walk you through everything you need to know about this essential coverage, focusing on how it works, what it covers, and why it matters. Understanding the basics will hel

Rodney Gatson

Jan 214 min read

Tips for Finding Budget-Friendly Insurance Plans

Finding the right insurance plan can feel overwhelming. You want solid coverage without breaking the bank. I’ve been there, and I know how important it is to find options that fit your budget while still protecting what matters most. Whether you’re looking for health, auto, home, or business insurance, there are smart ways to discover budget-friendly insurance plans that work for you. Let’s walk through some practical tips and strategies that will help you navigate the insura

Rodney Gatson

Jan 204 min read

Business Liability Protection: General Liability Insurance - What You Need to Know

When you’re running a business or managing your family’s financial security, understanding your protection options is crucial. One of the most important safeguards you can have is business liability protection. It’s a safety net that helps you avoid financial disaster if something unexpected happens. Today, I want to walk you through the essentials of this protection, focusing on a key component: general liability insurance . Let’s break it down in a way that’s easy to unders

Rodney Gatson

Jan 194 min read

Finding Term Life Insurance Near You: Your Guide to Local Life Policies

When it comes to protecting your loved ones and securing your financial future, term life insurance is a smart choice. But finding the right policy that fits your needs and budget can feel overwhelming. That’s why understanding local life policies and how to navigate your options is so important. I’m here to walk you through everything you need to know about term life insurance, especially how to find the best coverage near you. Term life insurance offers peace of mind by pr

Rodney Gatson

Jan 184 min read

Comprehensive Guide to General Liability Insurance Coverage

When it comes to protecting your financial future, understanding insurance is key. One of the most important types of insurance for individuals, families, and businesses is general liability insurance coverage. It acts as a safety net, shielding you from unexpected costs that could otherwise derail your financial stability. In this guide, I’ll walk you through everything you need to know about general liability insurance, helping you make informed decisions with confidence. U

Rodney Gatson

Jan 184 min read

Understanding Commercial Auto Insurance Coverage for Your Business Vehicle Insurance

When you own or operate a business vehicle, protecting it with the right insurance is crucial. You want to make sure you’re covered if something unexpected happens on the road. That’s where business vehicle insurance comes in. It’s designed to protect your vehicles, your business, and your peace of mind. Let’s dive into what this coverage means, why it matters, and how you can make the best choices for your needs. Why Business Vehicle Insurance Matters Business vehicles are m

Rodney Gatson

Jan 175 min read

Term vs Whole Life Insurance Explained: Your Life Plan Comparison

Choosing the right life insurance can feel overwhelming. You want to protect your loved ones and secure your financial future, but the options can be confusing. Two of the most common types are term life insurance and whole life insurance. Understanding the differences between them is key to making a smart choice that fits your needs and budget. Let’s break down these two types of life insurance in a clear, straightforward way. By the end, you’ll feel more confident about whi

Rodney Gatson

Jan 174 min read

Why Commercial Insurance is Essential: Your Guide to Business Coverage Solutions

Running a business is exciting, but it also comes with risks. Whether you own a small shop or manage a growing company, protecting your investment is crucial. That’s where business coverage solutions come in. They help you prepare for the unexpected and keep your business running smoothly. In this post, I’ll walk you through why having the right insurance matters, what options you have, and how to make smart choices for your business’s future. Understanding Business Coverage

Rodney Gatson

Jan 164 min read

Understanding Your Auto Coverage Necessity: Do You Need Commercial Auto Insurance?

When you think about protecting your vehicle, personal auto insurance might be the first thing that comes to mind. But what if you use your vehicle for business purposes? That’s where commercial auto insurance steps in. It’s not just an extra expense; it’s a crucial part of safeguarding your business and financial future. Let’s explore why commercial auto insurance might be necessary for you and how it can provide peace of mind. Why Auto Coverage Necessity Matters for Your Bu

Rodney Gatson

Jan 154 min read

Understanding Business Vehicle Coverage: A Guide to Commercial Auto Insurance

When you rely on vehicles for your work, protecting them is not just smart - it’s essential. Whether you own a small business or manage a fleet of vehicles, understanding business vehicle coverage can save you from unexpected costs and legal troubles. I’m here to walk you through the basics, so you feel confident about your choices and ready to protect your assets. Why Business Vehicle Coverage Matters You might think your personal auto insurance covers everything, but that’s

Rodney Gatson

Jan 144 min read

How Much Life Insurance You Need: A Practical Insurance Needs Assessment

When it comes to protecting your loved ones and securing your financial future, life insurance plays a crucial role. But one question often stands in the way: how much life insurance do I need? It’s a common concern, and the answer isn’t one-size-fits-all. Your needs depend on your unique situation, goals, and responsibilities. I’m here to guide you through a clear, friendly, and practical insurance needs assessment so you can make confident decisions. Life insurance isn’t j

Rodney Gatson

Jan 144 min read

Maximizing Business Security with Business Insurance Protection

Running a business is exciting, but it also comes with risks. You never know when an unexpected event might disrupt your operations or cause financial loss. That’s why business insurance protection is essential. It acts as a safety net, helping you bounce back from setbacks and keep your business running smoothly. In this post, I’ll walk you through how to maximize your business security with the right insurance coverage, practical tips to choose the best policies, and how t

Rodney Gatson

Jan 134 min read

Finding Budget-Friendly Insurance Plans: Your Guide to Smart Coverage

Navigating the world of insurance can feel overwhelming. You want to protect yourself, your family, or your business without breaking the bank. The good news? Finding budget-friendly insurance plans is possible with the right approach. I’m here to walk you through practical steps and tips to help you secure coverage that fits your needs and your wallet. Understanding Budget-Friendly Insurance Plans When I say budget-friendly insurance plans, I mean policies that provide solid

Rodney Gatson

Jan 124 min read

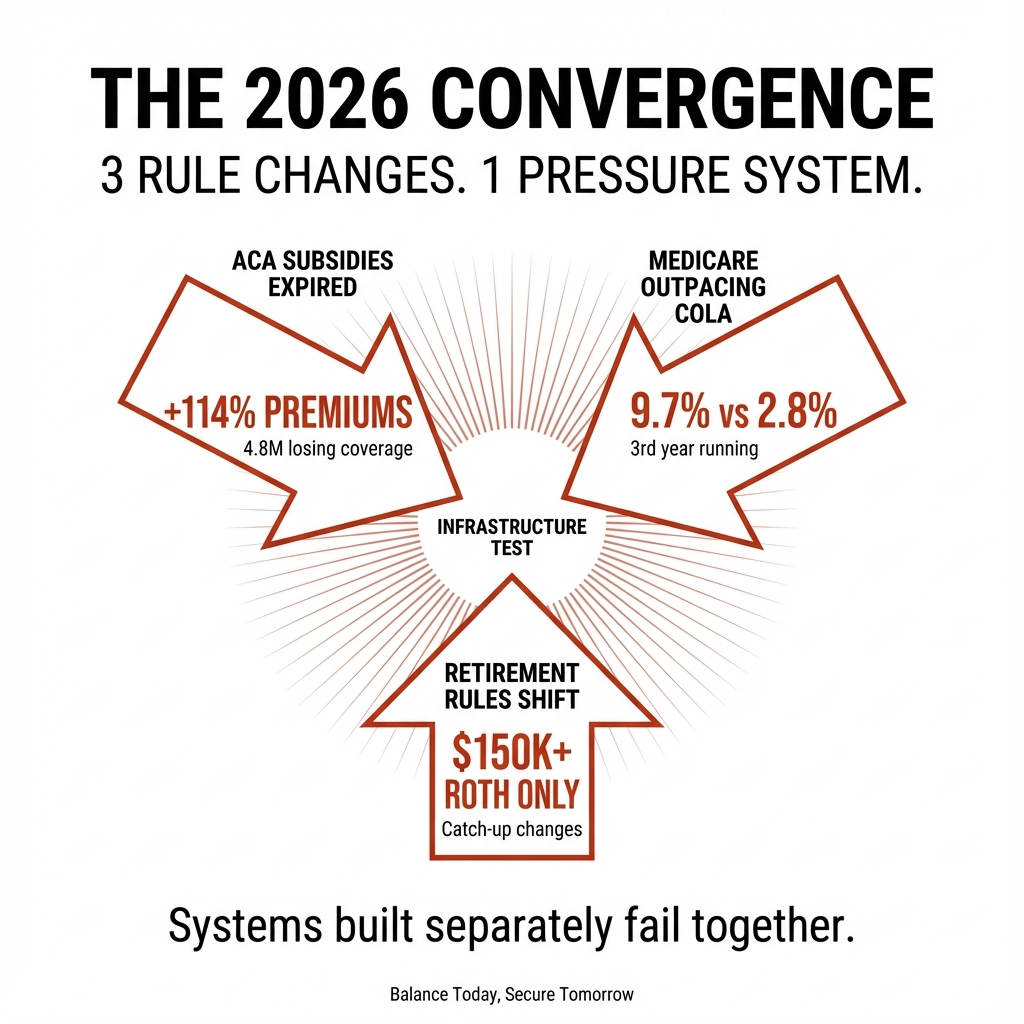

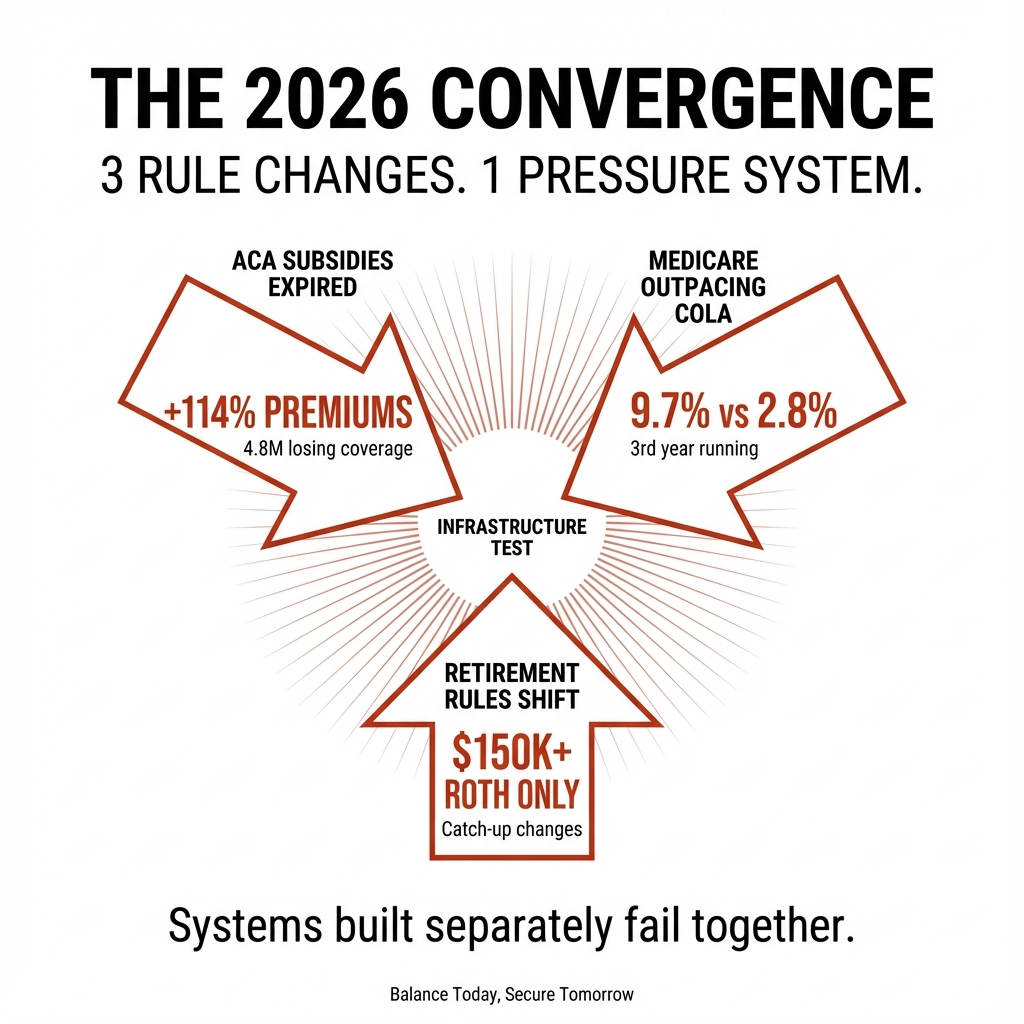

The 2026 Financial Convergence Nobody Saw Coming

TL;DR: Three major rule changes hit simultaneously in 2026: ACA subsidies expired causing 38-93% premium jumps, Social Security's 2.8% COLA gets eaten...

gatsonlfgroup

Jan 910 min read

Why "Declined" Doesn't Mean Uninsurable: What Independent Brokers Know That Captive Agents Won't Tell You

I've watched business owners shut down their search for insurance after a single declination letter. They assume the conversation is over. One carrie...

gatsonlfgroup

Jan 58 min read

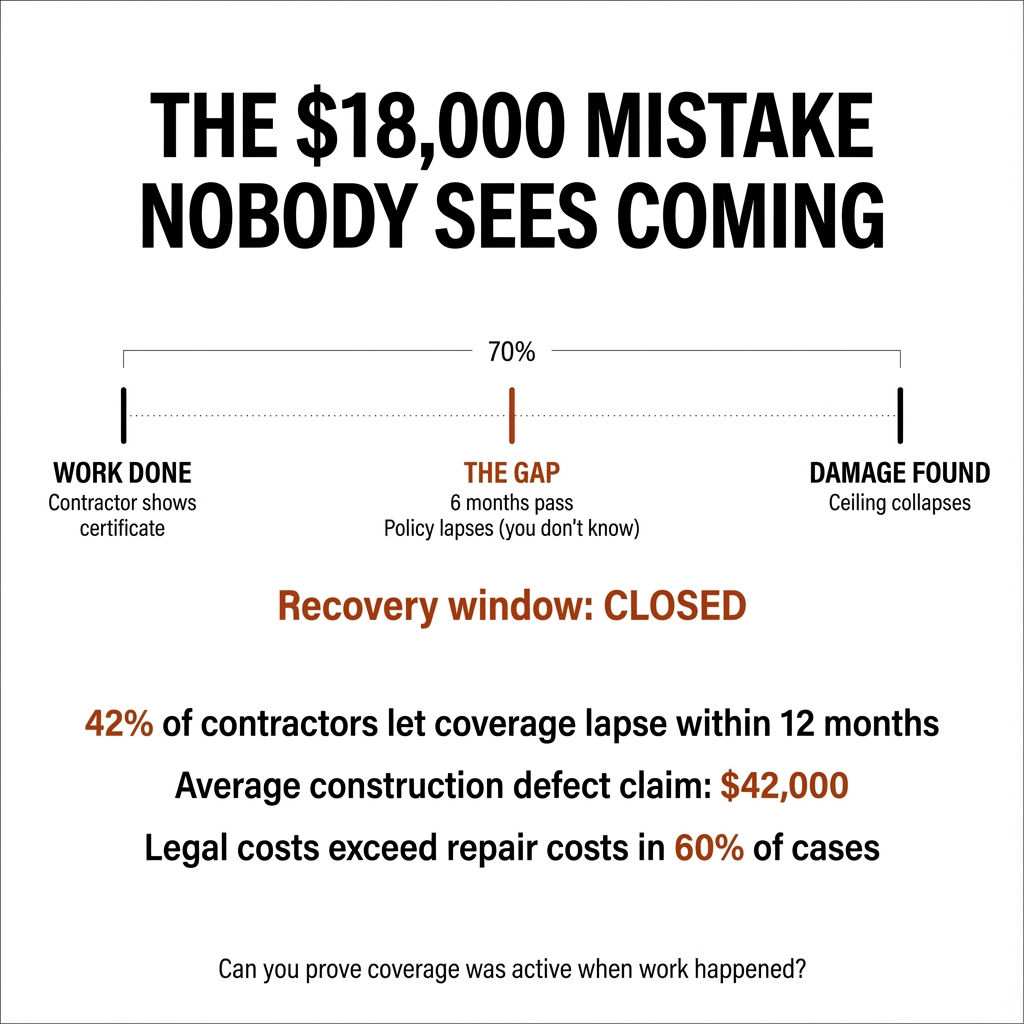

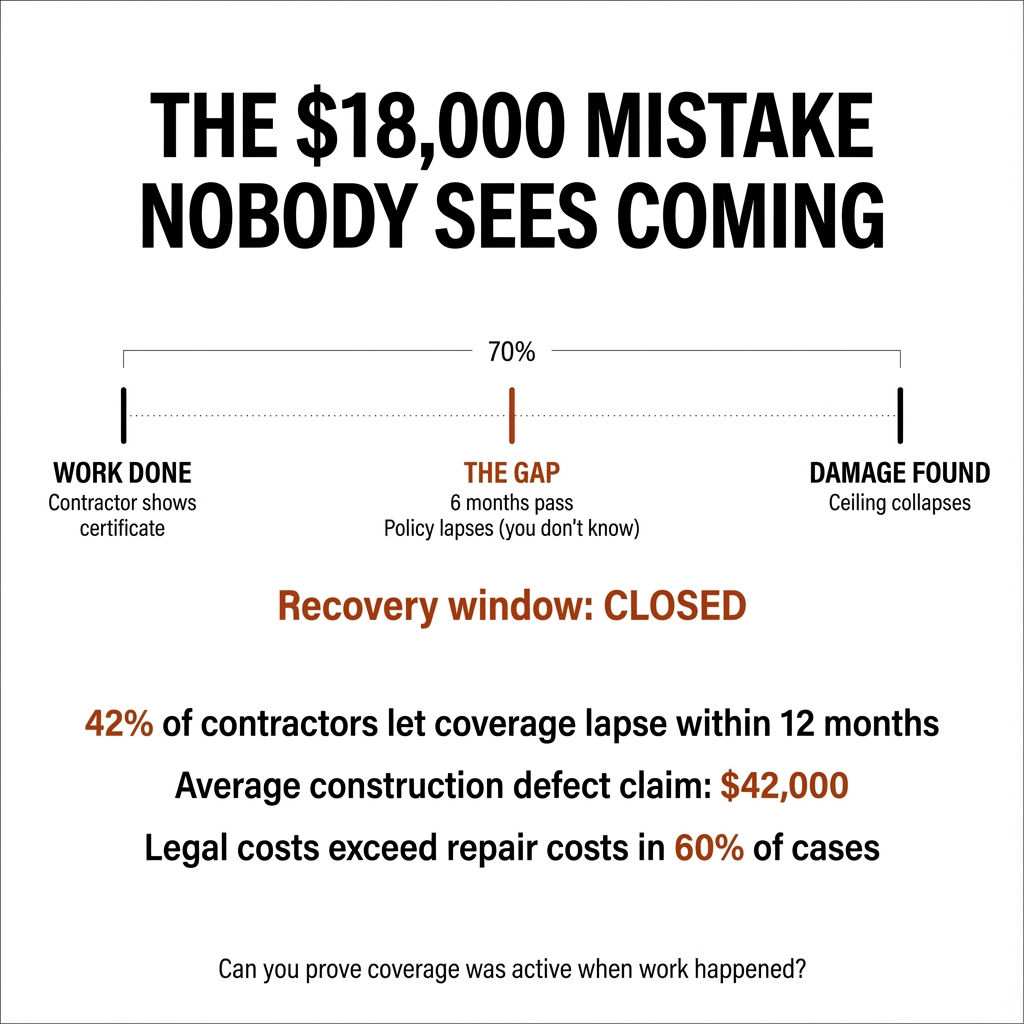

The $42,000 Question Nobody Asked Before the Roof Started Leaking

I got a call last Tuesday from a landlord in Atlanta.His tenant reported water damage. The ceiling in the living room had collapsed. The contractor wh...

gatsonlfgroup

Jan 57 min read

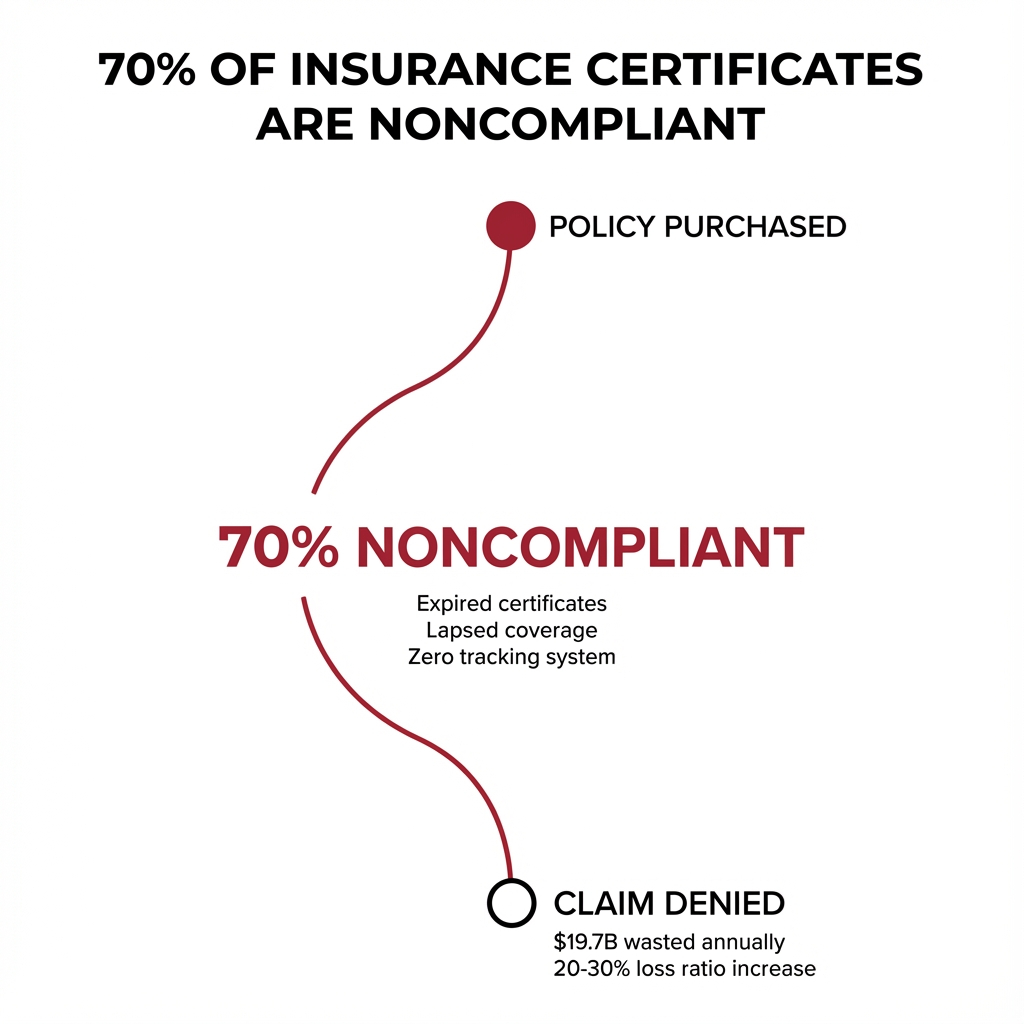

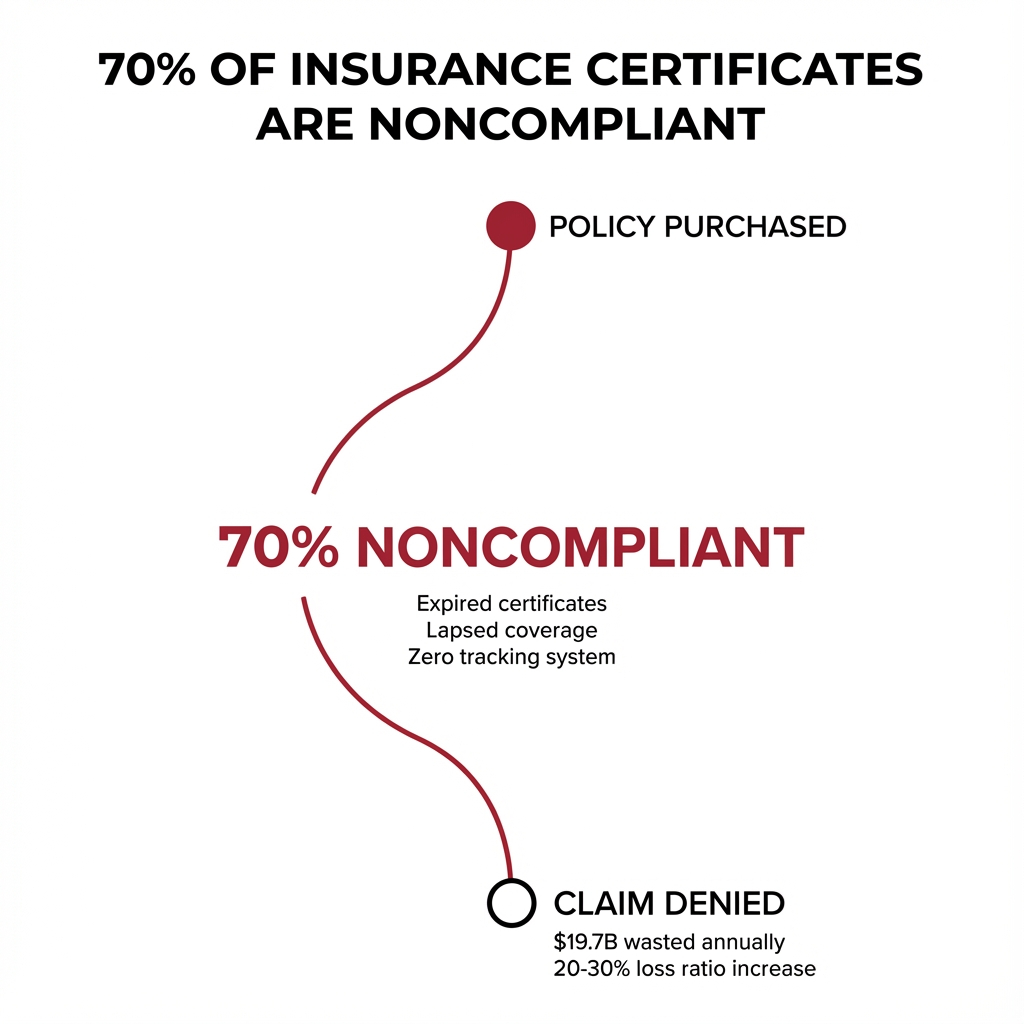

Insurance Isn't Broken—Your Compliance Infrastructure Is

I remember the landlord who walked into my office convinced his insurance was garbage.Three claims denied in 18 months. All contractor-related inciden...

gatsonlfgroup

Jan 49 min read

Essential Insurance Types and Coverage Needs for Starting Your Tree Service Company

Starting a Tree Service Company: Essential Insurance Coverage for Success ========================================================================== Starting a tree service company involves more than just having the right tools and skills. Protecting your business with the right insurance coverage is crucial to avoid costly setbacks and legal troubles. Knowing which types of insurance you need and how much coverage to carry can save your tree service startup from unexpected f

jozsolutions

Dec 10, 20254 min read

The Rise of Hyper-Personalization in Life Insurance for Modern Consumers

Life insurance has long been seen as a one-size-fits-all product, with standard policies offering fixed coverage and limited options. Today, that approach no longer meets the expectations of modern consumers. People want insurance that fits their unique lifestyles, health conditions, and financial goals. This shift has led to the rise of hyper-personalization in life insurance, transforming how policies are designed, priced, and managed. Why Hyper-Personalization Matters in L

gatsonlfgroup

Dec 7, 20253 min read

Gatson Life & Financial Group

Proudly designed by Gatdon Life & Financial Group

© 2035 by Gatson Life & Finacial Group

bottom of page